When you think of the Cayman Islands, you probably picture white sand beaches and turquoise waters. Maybe you know it’s a tax haven for billionaires.

But here’s what might surprise you: this tiny Caribbean territory holds $443 billion in US debt. That makes the Cayman Islands one of America’s top foreign creditors—ranking alongside economic giants like China and the UK.

How does a territory with just 70,000 people end up financing America’s $37 trillion debt pile? The answer reveals something fascinating about global finance.

The Cayman Islands US Debt Mystery: By the Numbers

Let’s put this in perspective:

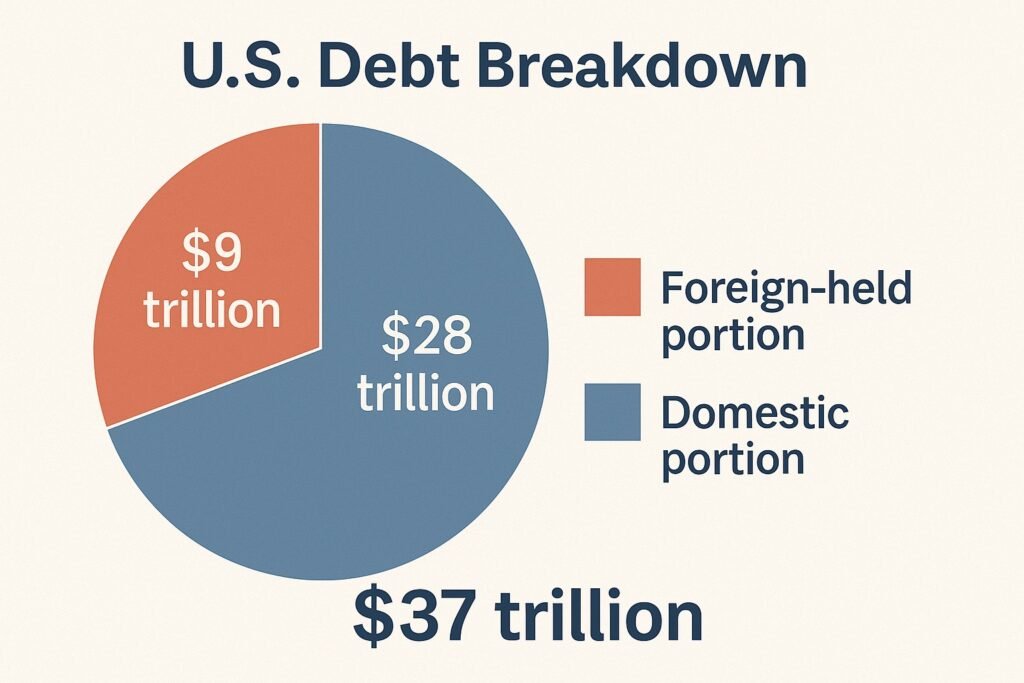

- Total US debt: $37 trillion

- Foreign-held portion: ~$9 trillion

- Cayman Islands holdings: $443 billion

- Cayman population: 70,000 people

That’s roughly $6.3 million in US debt per Cayman resident. Clearly, something else is going on here.

Most US Debt Stays Home (But $9 Trillion Doesn’t)

Before we solve the Cayman Islands mystery, here’s the big picture on US debt:

About three-quarters of America’s $37 trillion national debt is held domestically. The Federal Reserve owns a chunk. So do banks, mutual funds, pensions, and ordinary Americans who buy Treasury bonds.

The remaining $9 trillion? That’s held abroad, spread across countries and financial centers worldwide.

When the US Treasury releases its monthly “Major Foreign Holders” report, most names make perfect sense:

- Japan (America’s largest foreign creditor)

- China

- The United Kingdom

- Canada

But then there’s the Cayman Islands, holding nearly half a trillion dollars. For context, that’s more than most G20 countries hold in US debt.

Plot Twist: The Cayman Islands Government Isn’t Buying This Debt

Here’s where it gets interesting. The Cayman Islands government isn’t making policy decisions to invest in US Treasuries. Unlike Japan’s Ministry of Finance or China’s central bank, Cayman’s government isn’t the one writing these checks.

So who is?

International banks, hedge funds, and investment vehicles that are headquartered in the Cayman Islands.

Why Everyone Parks Money in the Cayman Islands

The Cayman Islands has become one of the world’s largest offshore financial centers. Despite having fewer residents than a small city, here’s what makes it a financial powerhouse:

The Magic Formula:

- Zero corporate taxes

- Light-touch regulation

- Strong legal protections (backed by British law)

- Political stability

The Results:

- Over 100,000 registered companies operate from Cayman

- More than 11,000 investment funds call it home

- It’s the top domicile for hedge funds globally

- An estimated $6 trillion in assets flows through Cayman financial institutions

The Real Reason Behind Cayman Islands US Debt Holdings

When these hedge funds and investment firms need safe, liquid assets to park money, what do they buy? US Treasuries.

Think of it this way: A pension fund in Canada might invest through a Cayman-registered fund. That fund buys US government bonds. On paper, those Treasuries are “held in Cayman.” In reality, the real investor is Canadian.

This is why economists call the Cayman Islands a “custodial center”—a place where legal ownership of assets gets recorded, even when the real investors are scattered globally.

It’s Not Just the Cayman Islands

This pattern explains why other small territories also rank among America’s top foreign creditors:

- Luxembourg: Another major financial hub

- Ireland: Corporate tax advantages attract global funds

- Switzerland: Traditional banking secrecy (though less than before)

These aren’t massive economies buying US debt for strategic reasons. They’re financial hubs facilitating global investment.

What the Cayman Islands Are Really Good At

The Cayman Islands hit the sweet spot for global finance:

British Legal Foundation

As a British Overseas Territory, Cayman combines local autonomy with UK legal credibility. The UK handles defense and foreign policy, but Cayman runs its own financial system.

This gives investors confidence in the legal framework without dealing with UK tax rates.

Tax Efficiency

Zero corporate tax rates make Cayman attractive for structuring international investments.

Regulatory Balance

Regulations exist (this isn’t the Wild West), but they’re designed to facilitate business rather than create barriers.

Why This Matters for the US Economy

The Cayman Islands’ role in US debt reveals three important things:

1. Global Demand for US Treasuries Remains Strong

Even through complex offshore structures, international money keeps flowing into US government bonds. This helps keep America’s borrowing costs low.

2. The Financial System Is More Connected Than It Appears

When we see “Cayman Islands” on the creditor list, we’re really seeing a web of global investors using Cayman as their legal structure.

3. There’s Concentration Risk

If global funds shifted away from Cayman-registered investments, those Treasury holdings could appear to “evaporate” from US data—even if the underlying investors just moved to different jurisdictions.

The Bigger Picture: It’s About Safety, Not Geography

The Cayman Islands may have just 70,000 residents, but in global finance, population doesn’t matter. What matters is:

- Legal framework

- Tax efficiency

- Regulatory environment

- Political stability

With nearly half a trillion dollars in US debt on its books, the Cayman Islands sits at the intersection of America’s borrowing needs and the world’s hunt for safe assets.

Key Takeaway: Follow the Money, Not the Map

Next time you see the Cayman Islands listed among America’s top creditors, remember: this isn’t about Caribbean geography.

It’s about how global finance actually works. The Cayman Islands US debt holdings illustrate how much of America’s borrowing flows through offshore banking centers, custodial arrangements, and the endless global search for financial safety.

The palm trees and beaches are nice. But the real action happens in glass office buildings where fund managers decide where to park trillions of dollars—and they keep choosing US government bonds.